-

Print

-

DarkLight

Transitioning Capital / Finance Leases

Background

Under ASC 842, capital leases are now recognized as finance leases. While the way these two leases are accounted for is virtually identical, the process of getting rid of capital leases and establishing finance leases can be difficult to get right.

Follow the steps below outlining the journal entries required to transition from ASC 840 capital leases to ASC 842 finance leases:

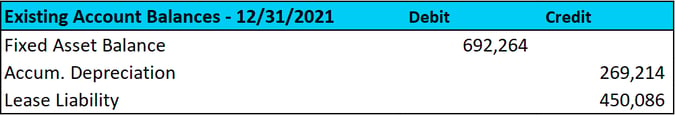

First, determine the existing fixed asset, accumulated depreciation, and lease liability balances on the company's balance sheet as of 12/31/2021. Next, remove the company's fixed assets, accumulated depreciation, and lease-liability balances from the balance sheet as of 1/1/2022 by making the following entry.

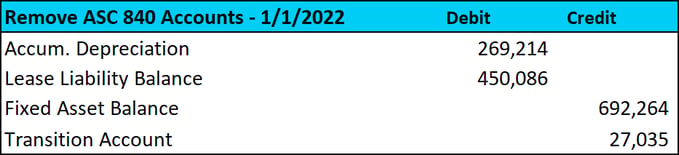

Next, remove the company's fixed assets, accumulated depreciation, and lease-liability balances from the balance sheet as of 1/1/2022 by making the following entry.

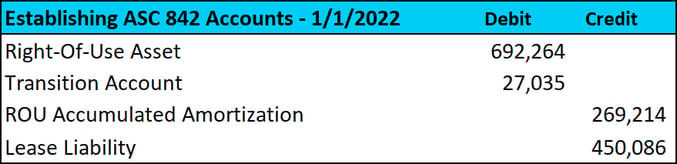

Lastly, establish lease liability, accumulated depreciation, and right-of-use asset balance as of 1/1/2022

Lastly, establish lease liability, accumulated depreciation, and right-of-use asset balance as of 1/1/2022

The above entries are a small example of the full spreadsheet, which you can download via the link below. It can show you a more in-depth and detailed visualization of this transition based on your own lease balances/inputs with additional information that might prove useful.

How To Enter into NetLease

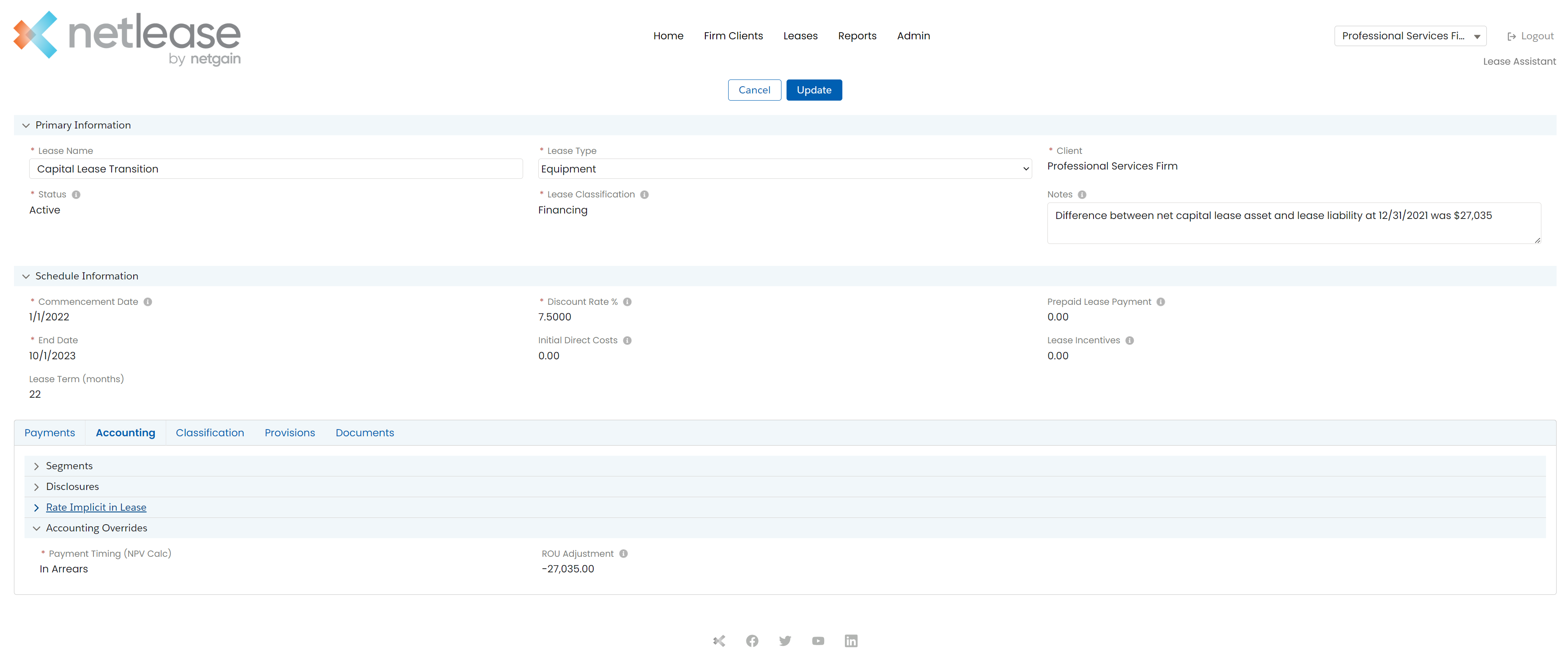

- Enter the payments from the transition date through the end of the lease

- Under the accounting tab, enter the difference between net capital asset (gross asset less accumulated depreciation) and lease liability in the ROU adjustment field. In the example above, this amount was 27,035.

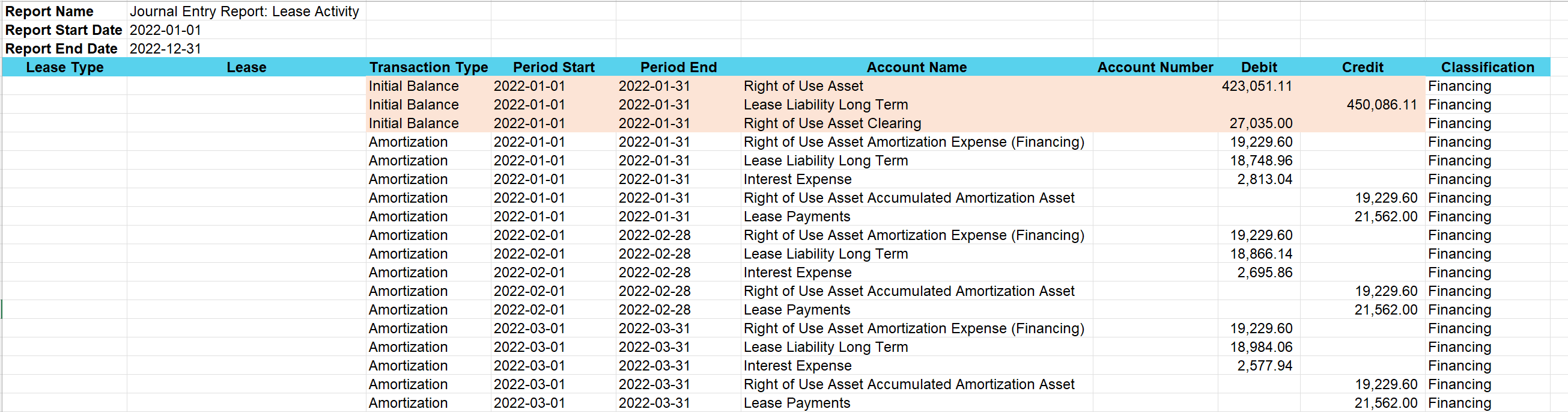

This process will create the journal entry shown below. The old capital lease asset and accumulated depreciation will need to be manually removed with another journal entry. NetLease does not provide the entry to remove old leases under ASC 840.