-

Print

-

DarkLight

Background

NetLease will amortize the ROU Asset on a straight-line basis over the life of the lease for finance leases. According to ASC 842-20-35-8, if a lessee is reasonably certain to exercise a purchase option or the asset transfers ownership at the end of the lease, the lessee shall amortize the right-of-use asset to the end of the useful life of the underlying asset. These finance leases need to be entered into NetLease in a specific manner. Note that the discount rate should be calculated based on the length of the lease liability, not based on the useful life of the underlying asset.

How To Enter into NetLease

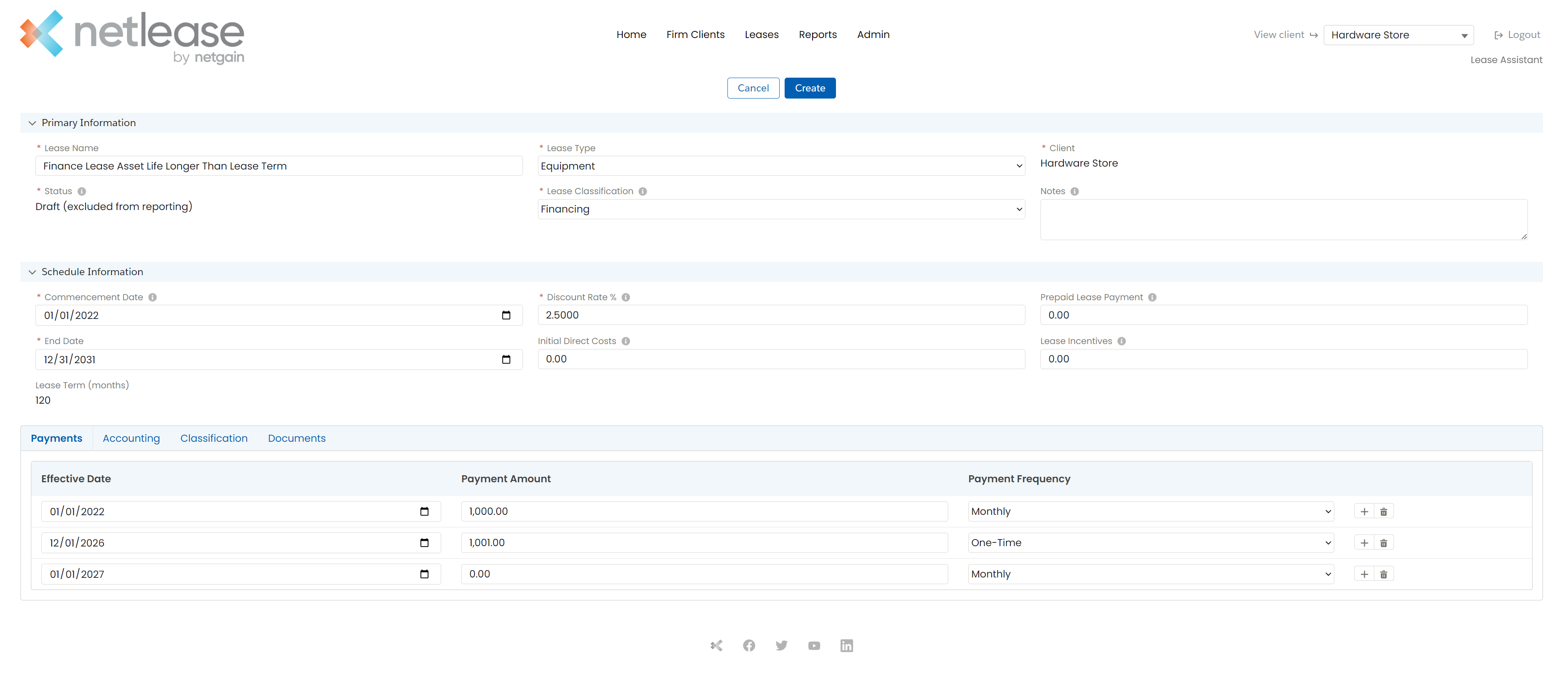

- Set the lease end date to the end of the asset’s useful life (not the end date of the lease).

- Add in a zero-dollar payment for all periods after the purchase or transfer date.

Example: if a lease is for 5 years, and the estimated life of the asset is 10 years, you will enter the end date as of the end of the asset’s useful life – here, it would be 12/31/2031. Then you enter a one-time payment at the end of the lease term, to represent the cost of the purchase option for the ROU Asset – here, that is shown as $1,001. Finally, you will enter a monthly payment amount of $0 for the remainder of the Asset’s Useful Life, as shown in the screenshot below.

This should produce the correct amortization amounts over the life of the asset and show the lease liability amortizing down by the end of the lease life – since the zero-dollar payments will result in zero liability from the purchase date going forward.

The weighted average remaining lease term disclosure report will automatically update to properly reflect the lease term ending when payments end. No manual adjustment is needed for any disclosure reports generated by NetLease.