-

Print

-

DarkLight

Use Case: Through the duration of a lease, there may be events or changes related to the lease agreement or underlying leased assets that require an adjustment to the original classifications. These changes can cause a reassessment or change in multiple components related to the lease, such as the following:

- Payment amounts expected under the lease

- Duration of the lease contract

- Triggering of additional requirements under the original terms of the contract

- Reassessments of the original expectations relative to renewal or termination options within the contract

- Indicators of reduced value of the underlying leased assets

NetLease makes it easy for you to execute the requirements by automating the accounting under each type of renewals, modifications, and impairments. Modifications can be initiated while the lease is commenced as well as at the end of the lease—appending the lease with an additional term.

Modifications: A modification is a change in the terms of a contract that were not part of the original terms (this includes lease renewals).

US GAAP (ASC 842 Glossary): A change to the terms and conditions of a contract that results in a change in the scope of or the consideration for a lease (for example, a change to the terms and conditions of the contract that adds or terminates the right to use one or more underlying assets or extends or shortens the contractual lease term).

IFRS (IFRS 16 Appendix A): A ‘lease modification’ is defined as “a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease (for example, adding or terminating the right to use one or more underlying assets, or extending or shortening the contractual lease term.”

The resulting adjustment can trigger different types of modifications:

- Modification accounted for as a separate contract > NetLease can create a separate lease contract and tag the original contract as a parent lease

- Modification resulting in a remeasurement of the lease liability > NetLease handles this as a “Standard Lease Modification”, which remeasures the lease liability and any differences are recorded against the ROU asset

- Modification reducing the scope of the lease (partial termination) > NetLease handles this as a “Decrease in Scope” modification, which both (1) remeasures the lease liability and (2) has a P&L impact for the reduction in scope

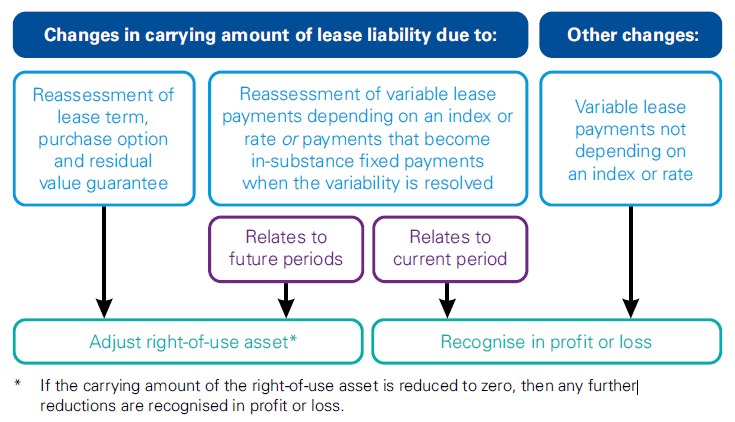

KPMG provides the following diagram highlighting the various modifications types:

Use Case: Through the duration of a lease, there may be events or changes related to the lease agreement or underlying leased assets that require an adjustment to the original classifications. These changes can cause a reassessment or change in multiple components related to the lease, such as the following:

- Payment amounts expected under the lease

- Duration of the lease contract

- Triggering of additional requirements under the original terms of the contract

- Reassessments of the original expectations relative to renewal or termination options within the contract

- Indicators of reduced value of the underlying leased assets

NetLease makes it easy for you to execute the requirements by automating the accounting under each type of renewals, modifications, and impairments. Modifications can be initiated while the lease is commenced with journals booking as well as at the end of the lease—appending the lease with an additional term. Modifications can also be initiated on non-GL impacting leases.

Modifications: A modification is a change in the terms of a contract that were not part of the original terms (this includes lease renewals).

US GAAP (ASC 842 Glossary): A change to the terms and conditions of a contract that results in a change in the scope of or the consideration for a lease (for example, a change to the terms and conditions of the contract that adds or terminates the right to use one or more underlying assets or extends or shortens the contractual lease term).

IFRS (IFRS 16 Appendix A): A ‘lease modification’ is defined as “a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease (for example, adding or terminating the right to use one or more underlying assets, or extending or shortening the contractual lease term.”

The resulting adjustment can trigger different types of modifications:

- Modification accounted for as a separate contract > NetLease can create a separate lease contract and tag the original contract as a parent lease

- Modification resulting in a remeasurement of the lease liability > NetLease handles this as a “Standard Lease Modification”, which remeasures the lease liability and any differences are recorded against the ROU asset

- Modification reducing the scope of the lease (partial termination) > NetLease handles this as a “Decrease in Scope” modification, which both (1) remeasures the lease liability and (2) has a P&L impact for the reduction in scope

KPMG provides the following diagram highlighting the various modifications types:

Source: KPMG—Lease Modifications—Accounting for changes to lease contracts - IFRS 16, September 2018