-

Print

-

DarkLight

Background

The FASB requires a "modified retrospective transition method" for adopting ASC 842. With this modified retrospective approach, two options exist. Companies may elect either the Comparative Method or the Effective Method, which must be selected for all leases. ASU 2018-11 outlines the full FASB guidance.

Modified Retrospective Transition - Comparative Method

Under the comparative method, prior periods must be adjusted to reflect ASC 842 if they are presented as comparative financial statements. For leases that commenced prior to the beginning of the earliest comparative period presented, a cumulative effect adjustment will need to be recognized at that date. This option is difficult and time-consuming. Unless required by an investor, bank, etc., this method should be avoided.

Modified Retrospective Transition - Effective Method

The effective method does not require an adjustment to periods prior to adoption. Comparative financials will still be presented under ASC 840 with their associated required disclosures. Leases will simply be presented at the adoption date going forward using a cumulative-effect adjustment at that date.

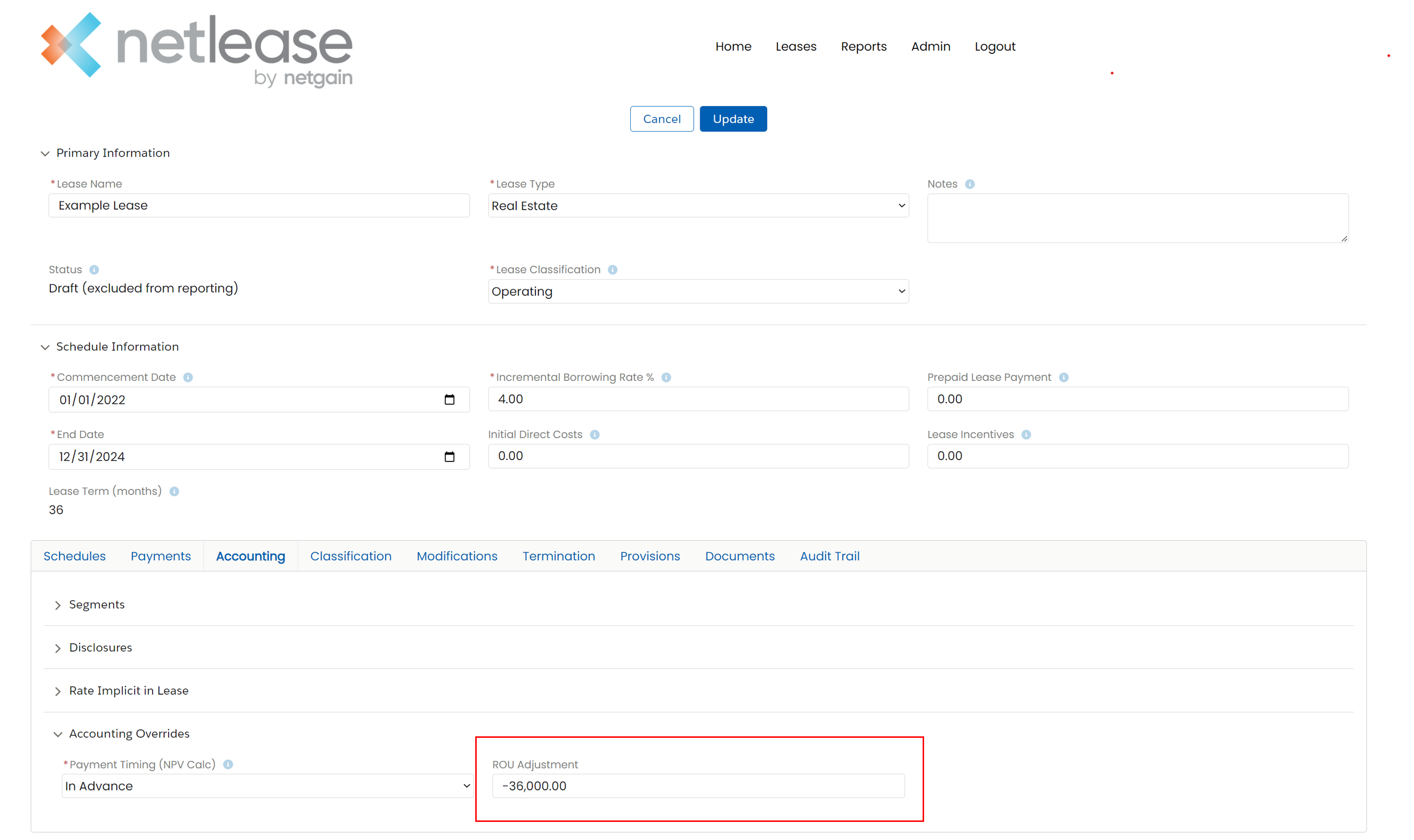

Consider a 10-year lease that commenced 1/1/2015. Under the effective method, the lease would be entered into NetLease on 1/1/2022 with the three years of remaining payments, not the full 10 years. NetLease will produce the correct ROU asset and lease liability as of 1/1/2022 going forward. If this lease has deferred rent recorded on the balance sheet, enter the amount recorded at 12/31/2021 in the ROU Adjustment field under the Accounting tab (see screenshot below). Credit balances of deferred rent will be entered as a negative number, as shown in the example.

Short-term Lease Transitions

The effective method cannot be used to create superficial short-term leases. If a lease term is greater than 12 months at commencement, it must be included in ASC 842 calculations. For example, if a 10-year lease ends in October 2022 an entity must still recognize the ROU asset and corresponding liability at 1/1/2022 and amortize the lease over the next 10 months when the effective method for transition is selected.