-

Print

-

DarkLight

Background

The FASB provided a few areas of relief to allow an easier transition to ASC 842. Most of the reliefs must be applied in certain manners in order to qualify for the election. Some of these reliefs are also not mandatory at all. At Netgain, we've helped numerous clients through the process of ASC 842 adoption and will include what types of elections we've seen our clients make on these areas of relief.

Inclusion/exclusion of short-term or low-value leases

As an accounting policy, a lessee may elect not to apply the recognition requirements to short-term leases. Instead, a lessee may recognize the lease payment in profit or loss on a straight-line basis over the lease term and variable lease payments in the period in which the obligation for those payments is incurred. A common question is, "Well, the lease is technically on a month-to-month basis. We've renewed each month for years and will likely keep doing so. Does this mean we get to leave this lease off of the balance sheet?" If this is the case, the lease does not qualify for the short-term exclusion. ASC 842-20-25-3 mentions that a lease that is reasonably certain to be extended beyond 12 months does not meet the definition of a short-term lease. The key is intent. While a lease may be on a month-to-month basis, the intent of a longer lease must be recognized. If this intent changes in the future, a lease modification must be recorded to reflect a change from the original intent.

See also transition methods for long-term leases with fewer than 12 months remaining at the adoption date.

Guidance

ASC 842-20- 25-2

What We’ve Seen

This is typically elected. Doing so reduces the level of effort for implementation and ongoing accounting. As for the low-value threshold, no prescribed dollar amount was given from FASB (but note the IFRS threshold is $5,000). Many companies use their fixed-asset capitalization limit for leases as well. This low-value threshold refers to the total lease liability, not the monthly lease payment.

Separating lease from non-lease components

A lessee may choose not to separate non-lease components from lease components. Instead one can account for each separate lease component and the non-lease components associated with that lease as a single lease component.

Guidance

ASC 842-10-15- 37

What We’ve Seen

This one sounds a lot worse than it really is. This relief is typically elected simply due to the high level of effort required during the analysis to determine the stand-alone selling prices of the non-lease components. See Non-Lease Components section for more details.

Discount rate used

A lessee that is not a public business entity is permitted to use a risk-free discount rate for the lease instead of its incremental borrowing rate, determined using a period comparable with that of the lease term, as an accounting policy election made by class of underlying asset.

Guidance

ASC 842-20- 30-3

What We’ve Seen

The vast majority of privately held companies are electing to use the risk-free rate despite the balance-sheet gross-up effects. See Discount Rate section for more details on discount rate selection and calculation.

Portfolio approach

A lessee may account for its leases at a portfolio level provided that the application of the leases model to the portfolio would not differ materially from the application of the leases model to the individual leases in that portfolio.

Guidance

ASU 2016-02 BC120

What We’ve Seen

This one is not typically elected. In theory, this approach is possible, but clients rarely have a portfolio of leases with characteristics similar enough to be accounted for at a portfolio level. This approach can also get very difficult when a portfolio is made up of similar leased assets that are traded out in the middle of a lease term. For example, if a company leases a fleet of new vehicles on a three-year lease, a change may need to take place where one of those vehicles is swapped out after a year or two and a new three-year lease will commence with the single new vehicle.

Use of hindsight

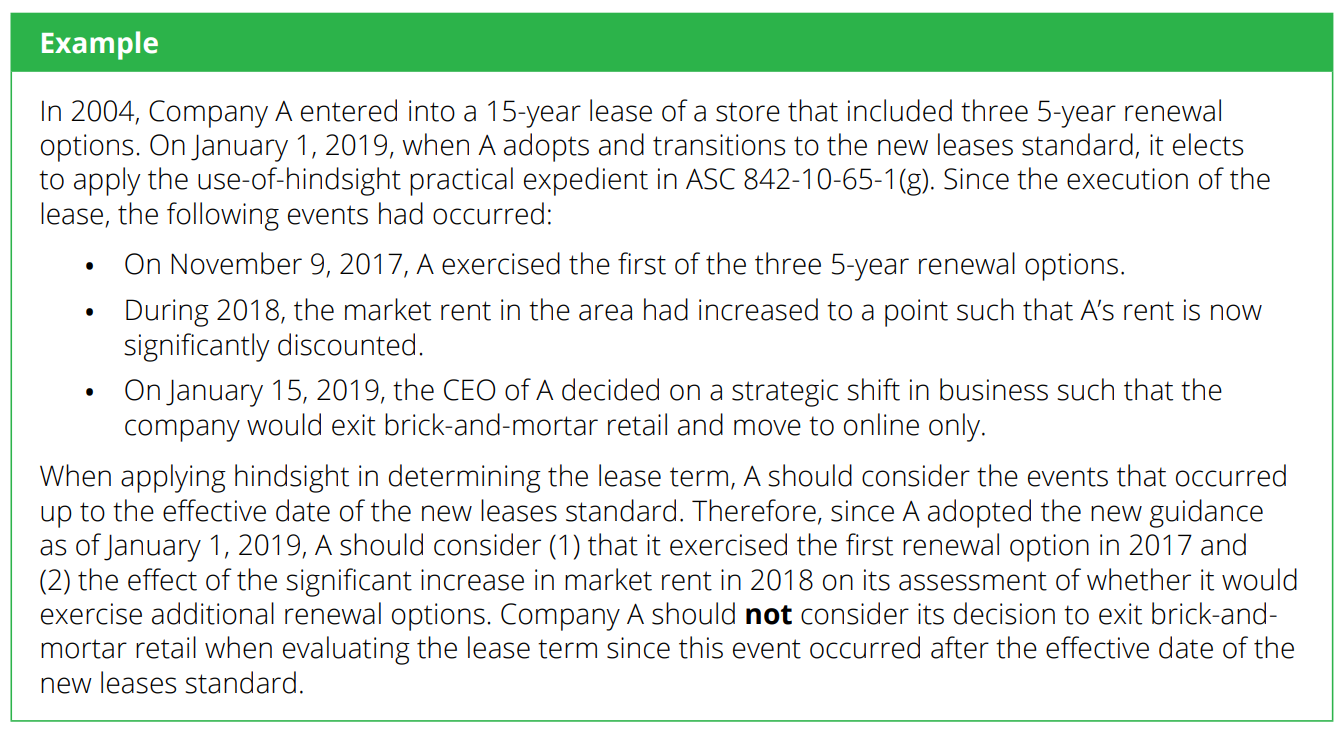

An entity may also elect a practical expedient, which must be applied consistently by an entity to all of its leases (including those for which the entity is a lessee or a lessor) to use hindsight in determining the lease term (that is, when considering lessee options to extend or terminate the lease and to purchase the underlying asset) and in assessing impairment of the entity’s right-of-use assets. Deloitte offers an example of how the use of hindsight would be applied below:

Guidance

ASC 842-10- 65-1

What We’ve Seen

Most do not elect to use hindsight due to the high cost and effort for little benefit.

Package of three practical expedients

An entity may elect the following practical expedients, which must be elected as a package and applied consistently by an entity to all its leases (including those for which the entity is a lessee or a lessor), when applying the pending content that links to this paragraph to leases that commenced before the effective date:

1) An entity need not reassess whether any expired or existing contracts are or contain leases.

2) An entity need not reassess the lease classification for any expired or existing leases (that is, all existing leases that were classified as operating leases in accordance with Topic 840 will be classified as operating leases, and all existing leases that were classified as capital leases in accordance with Topic 840 will be classified as finance leases).

3) An entity need not reassess initial direct costs for any existing leases.

Guidance

ASC 842-10-65

What We’ve Seen

This one is typically elected. Doing so greatly improves implementation efficiency and doesn’t require anyone to re-open old wounds of concluding on lease existence, classification, and direct cost calculation.