-

Print

-

DarkLight

Transition Entries at End of Reporting Period

Overview

This article provides guidance on booking ASC 842 transition entries at the end of the reporting period where the adoption date was at the beginning of the reporting period. Since cash payments and rent expense are typically recorded as they occur throughout the period, companies need to consider what has already been booked and avoid double-booking. To assist with this process, this article walks through an example lease with two different expense recognition patterns - straight-line and cash basis - and discusses the transition entry options available, including reversing prior months or booking a true up entry.

This article is not meant to opine or provide guidance on accounting methods used prior to implementation of ASC 842, but rather to help companies reconcile their existing GL with the entries generated from NetLease.

Here we use deferred rent as an example, but other input fields such as prepaid rent, initial direct costs, and lease incentives follow the same logic.

Transition Entry Options

The approaches outlined below depend on the company's reporting requirements and processes. Netgain always recommends working with your auditors to determine the best approach.

Option 1: Reverse prior months

The company can reverse/delete all lease-related entries from the year and book according to NetLease. This approach is easiest, but if the company has reported quarterly or monthly throughout the year, it may not want to restate prior months/quarters

Option 2: true up entry

Instead of restating prior period reporting, companies could book an entry to true up its deferred rent or rent expense during December. This will cause P&L volatility but may be the easiest operationally.

The remainder of this article walks through an example lease under straight-line and cash basis expense recognition patterns to guide companies through the thought process of generating true-up entries.

Example lease facts

Lease Facts: |

|

Start Date | 1/1/2021 |

End Date | 12/13/2023 |

Term (Months) | 36 |

Discount Rate | 1% |

Monthly Payments 2021 | 900 |

Monthly Payments 2022 | 1,100 |

Monthly Payments 2023 | 1,200 |

Average Expense | 1,067 |

Lease Classification | Operating |

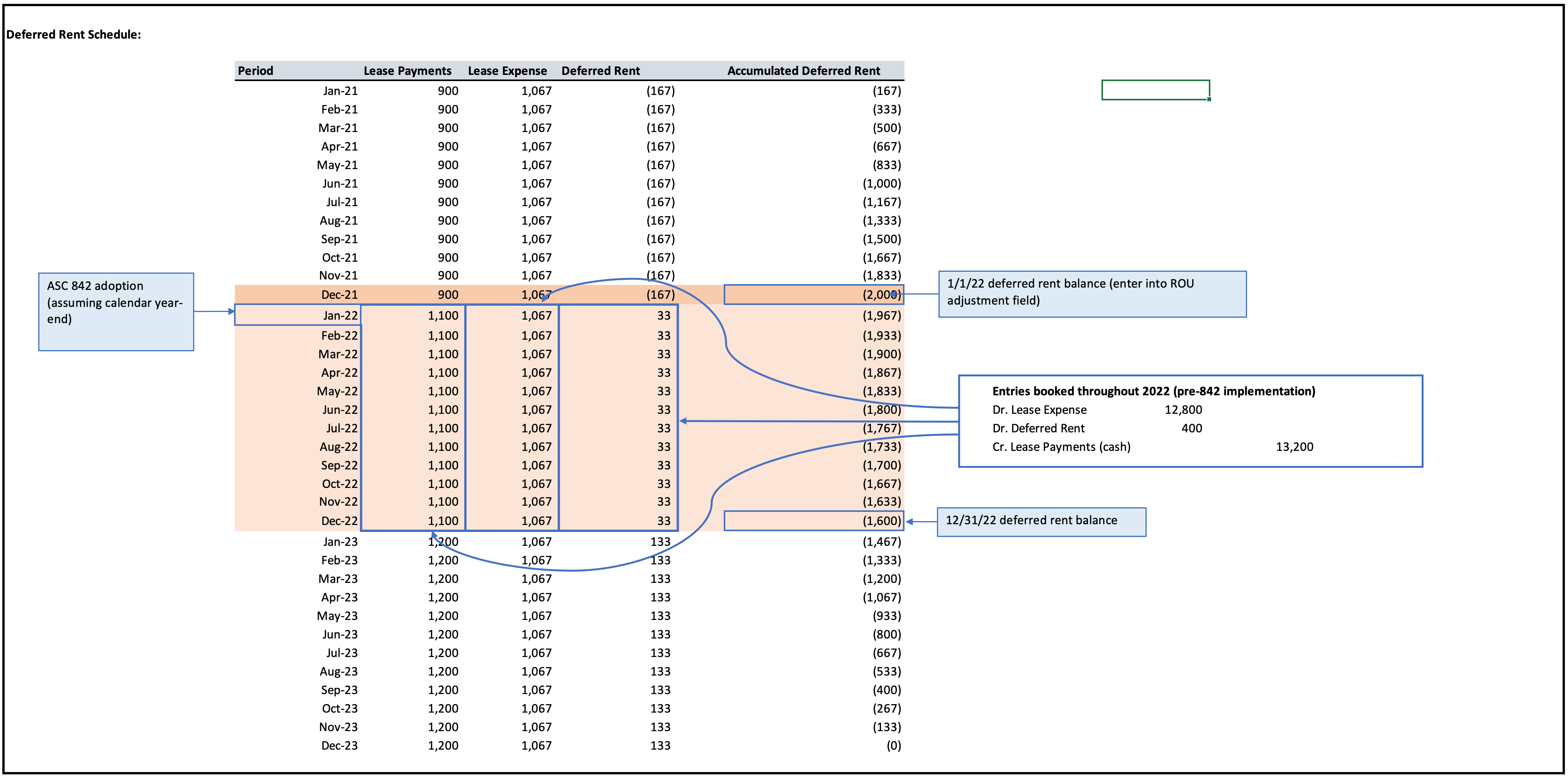

Use Case 1: Straight-line rent

Entries booked during the year:

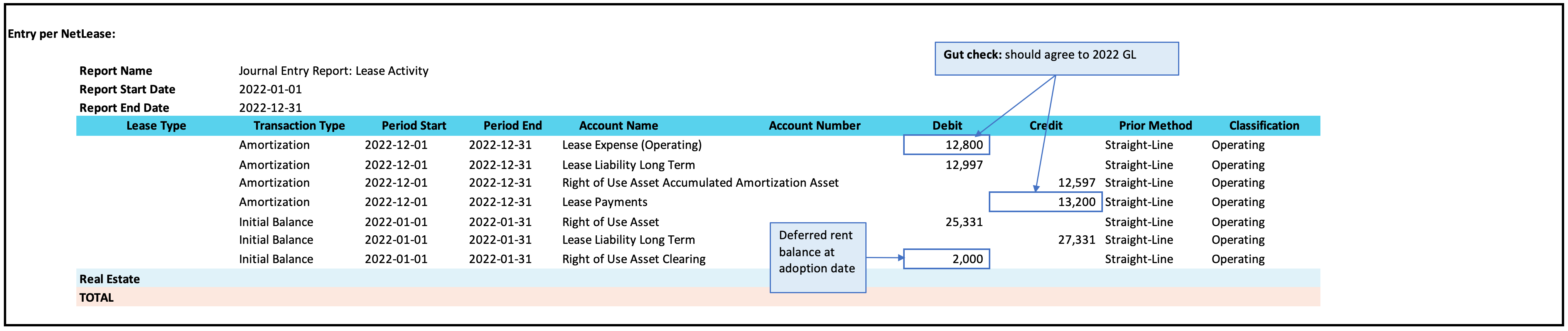

2022 Entries Per NetLease:

Step 1: Before booking their 842 adoption entries, companies should confirm that the rent expense and cash payments shown in the NetLease journal entries agree to GL activity for the year. If they don’t agree, companies should double-check their work. It’s possible that the payment schedule or deferred rent balance were entered incorrectly. Items such as Lease Improvements will impact the straight line rent expense recoded in NetLease so those should be contemplated as well, if relevant.

Step 2:

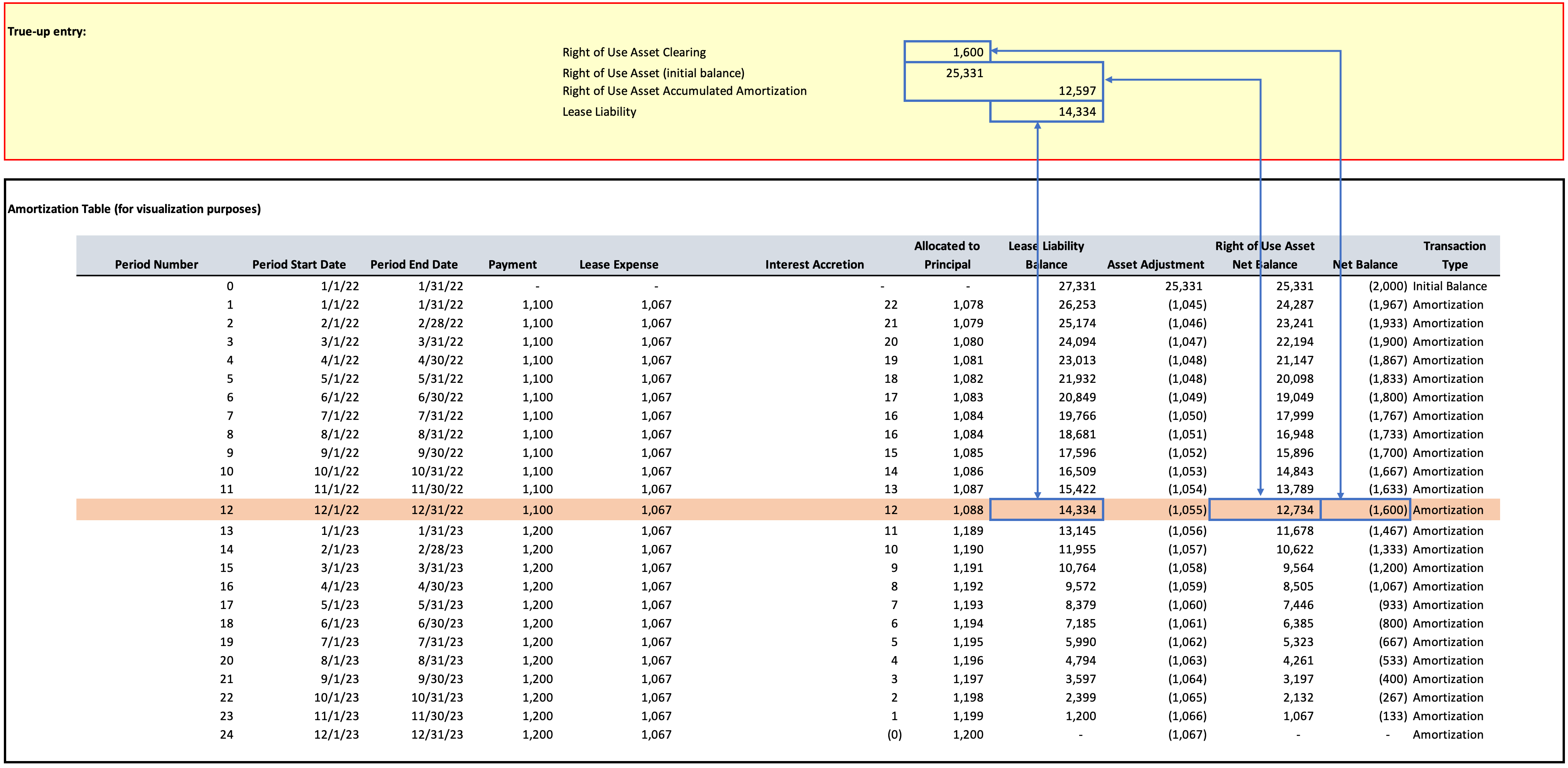

For companies that recorded rent expense on a straight-line basis and built up a deferred rent balance throughout 2022, it is necessary to write off the balance that has been built up over the year. It is also necessary to capitalize and amortize right-of-use assets and lease liabilities.

The above entry, which companies might book at the end of the year, accomplishes the following:

- Zero out remaining $1,600 deferred balance

- Capitalize ROU asset and liability

- Amortize ROU asset and liability for 12 months

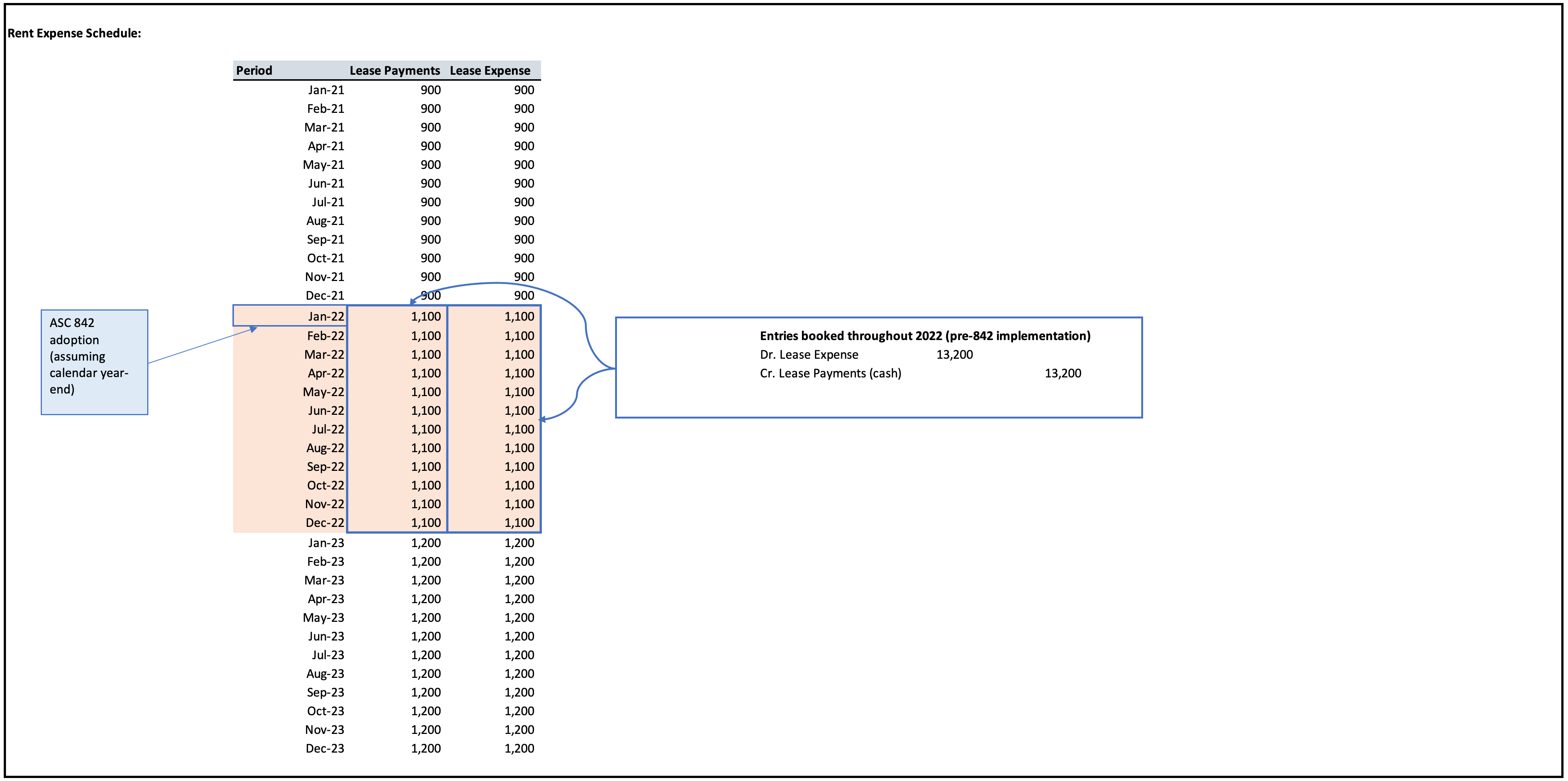

Use Case 2: Cash basis

Entries booked during year:

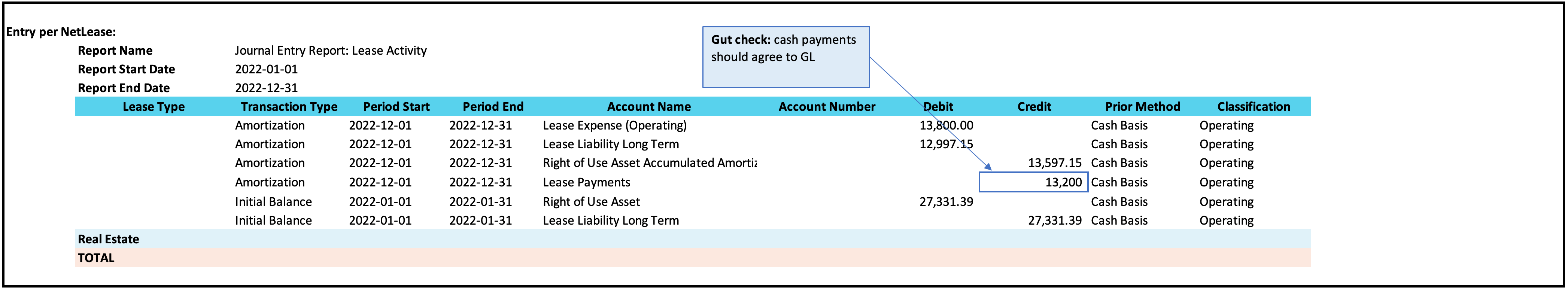

2022 Entries Per NetLease:

Step 1:

Before booking their 842 adoption entries, companies should confirm that the cash payments shown in the NetLease journal entries agree to GL activity for the year. If they don’t agree, companies should double-check their work. It’s possible that the payment schedule was entered incorrectly.

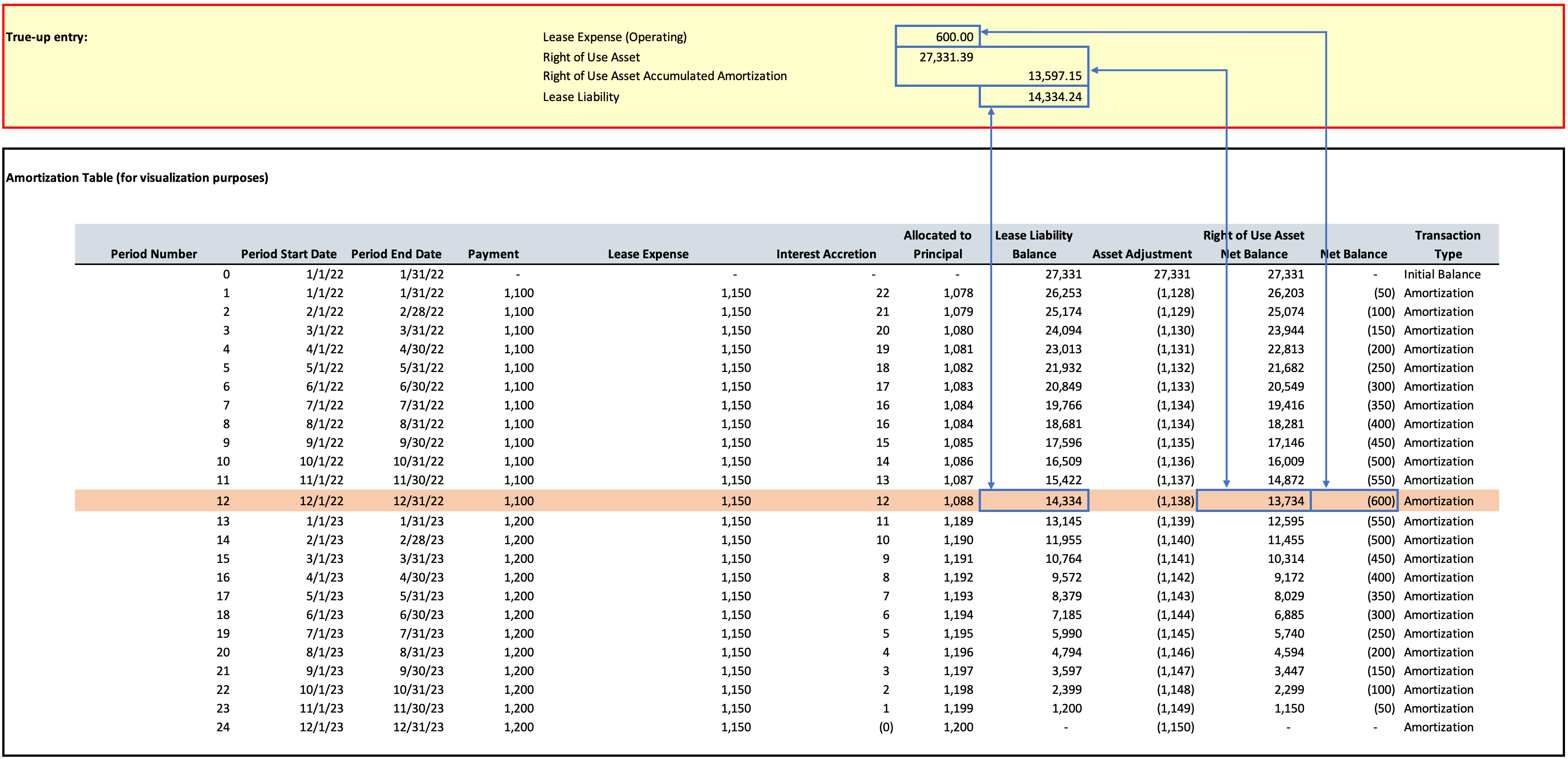

Step 2:

ASC 842 requires companies to straight-line rent expense. For companies that recorded rent expense based on cash payments throughout the year, it may be necessary to true up rent expense. If rent payments change over the term of the lease, it is possible that the company has under-recorded or over-recorded their expense during the year.

The above entry, which companies might book at the end of the year, accomplishes the following:

- True up rent expense to the amount it would have been under straight-line, as required by ASC 842

- Capitalize ROU asset and liability

- Amortize ROU asset and liability for 12 months

Final Checks:

After booking all lease-related entries for the year, the company should perform the following checks:

- Verify rent expense, cash payments, and year-end ROU asset and liability balances agree between NetLease and its GL.

- Confirm there is no longer a deferred rent balance, unless the balance includes COVID repayments that have not been built into NetLease.

- Confirm there is no longer a balance of prepaid rent or lease incentive liabilities, as ASC 842 builds these into the ROU assets and liabilities.